EU Overview

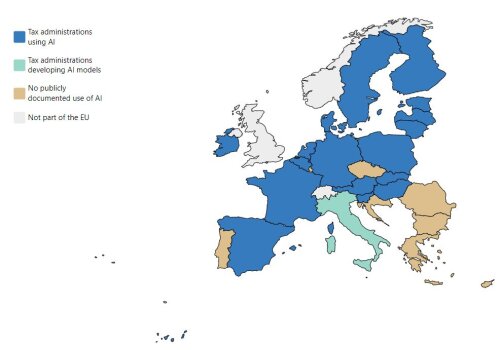

The map below shows which EU Member States use machine-learning algorithms* to perform their fiscal prerogatives. To consult the current state of use of machine-learning in a specific EU Member State, consult our country reports.

Currently there are publicly documented use of tax machine-learning algorithms in 18 EU Member States, hence at least 67% of tax administrations in the EU make use of artificial intelligence/machine-learning technology to automate the performance of some of their fiscal missions

*By machine-learning we refer to algorithms who are not programmed with pre-defined rules to transform inputs into outputs, but rather autonomously learn these rules through the analysis of historical data. For more precise definitions of AI and machine-learning see the definitions of AI by the OECDor by the EU AI High-Level Expert Group.