EUROMOD - Microsimulation model of tax benefit policies of the European Member States

Introduction

EUROMOD is an arithmetic microsimulation model: it simulates individual and household tax liabilities and benefit entitlements according to the policy rules in place. Its main purpose is to gain insight into the consequences of policy changes (ex-ante policy analysis) on specific households or on the income distribution but can also be used to isolate policy changes from economic and socio-demographic evolutions, for the calculation of budget constraints or to facilitate international comparisons.

EUROMOD’s most unique feature is that it is a tax-benefit model for all 27 EU Member States and the United Kingdom, running on purpose-built software. This has a number of advantages:

- A flexible and transparent tax-benefit modelling language that is the same for all national tax benefit models

- Cross-national comparability

- Possibility to simulate EU wide policy reforms

- Can act as a library of policies

- Policy extensions or complex policy reforms are possible

- Expert users can link to labour supply or macro-economic models

Scope

EU-28, 2005 – 2019 (some countries only available for later years).

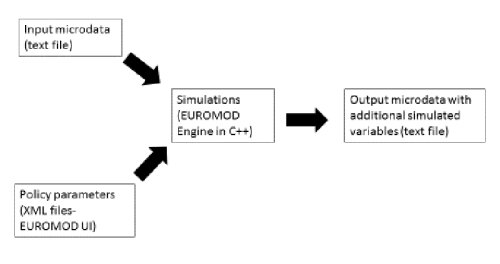

The software

Structure

Input data

Input data can either be microdata or hypothetical household data. In order for EUROMOD to be able to work with the data, the input data must:

- Include compulsory variables (id, age, marital status, current education, disability, economic status, occupation, etc.)

- Not have missing values

- Monetary variables must be reported on (average) monthly basis

- Follow the EUROMOD naming convention

The functionality of EUROMOD ultimately depends on the quality and information comprised in the input data.

Microdata

- EUROMOD is specifically built for and delivers ready-to-use input data files based on EU-SILC, but also other microdata can be adapted to the EUROMOD format (e.g. HFCS, administrative data)

- EU-SILC based data definitions are provided in the DRD

- EUROMOD simulations on microdata show first-order effects for the population at large, when simulating a reform

Hypothetical household data

EUROMOD can also calculate net disposable incomes and income components for custom-defined hypothetical households.

- Input data are then made by the EUROMOD add-on HHoT (Hypothetical Household Tool)

- EUROMOD simulations on hypothetical household data are used for errorshooting, illustrative purposes, and for focusing on the generosity and interplay of policies for small subgroups of the population

- We have ready-to-use hypothetical household indicators on the adequacy of minimum wages, social assistance and minimum income guarantee elderly (all 2009-2019): MIPI-HHoT dataset

CSB's involvement in EUROMOD

The Belgium national EUROMOD team is based at the University of Antwerp and KU Leuven. The current team members are:

- University of Antwerp: Ella-Marie Assal, Johannes Derboven, Sarah Kuypers & Gerlinde Verbist

- KU Leuven: André Decoster, Liebrecht De Sadeleer, Sebastiaan Maes, Zoé Rongé, Jonas Vanderkelen, Toon Vanheukelom & Stijn Van Houtven.

Resources

Please visit https://www.euromod.ac.uk/ for more information on access to the data and user training and support. You can find all country reports, working papers and other publications here as well.